Fires are destructive, indifferent, and they can grow and spread very fast.

Fires are destructive, indifferent, and they can grow and spread very fast.

The picture is of the Buncefield explosion and conflagration that occurred on 11th December 2005 near Hemel Hempstead in the UK. The root cause was a faulty switch that failed to prevent tank number 912 from being overfilled. This resulted in an initial 300 gallon petrol spill which created the perfect conditions for an air-fuel explosion. The explosion was triggered by a spark and devastated the facility. Over 2000 local residents needed to be evacuated and the massive fuel fire took days to bring under control. The financial cost of the accident has been estimated to run into tens of millions of pounds.

The Great Fire of London in September 1666 led directly to the adoption of new building standards – notably brick and stone instead of wood because they are more effective barriers to fire.

A common design to limit the spread of a fire is called a firewall.

And we use the same principle in computer systems to limit the spread of damage when a computer system goes out of control.

Money is the fuel that keeps the wheels of healthcare systems turning. And healthcare is an expensive business so every drop of cash-fuel is precious. Healthcare is also a risky business – from both a professional and a financial perspective. Mistakes can quickly lead to loss of livelihood, expensive recovery plans and huge compensation claims. The social and financial equivalent of a conflagration.

Financial fires spread just like real ones – quickly. So it makes good sense not to have all the cash-fuel in one big pot. It makes sense to distribute it to smaller pots – in each department – and to distribute the cash-fuel intermittently. These cash-fuel silos are separated by robust financial firewalls and they are called Budgets.

The social sparks that ignite financial fires are called ‘Niggles‘. They are very numerous but we have effective mechanisms for containing them. The problem happens when a multiple sparks happen at the same time and place and together create a small chain reaction. Then we get a complaint. A ‘Not Again‘. And we are required to spend some of our precious cash-fuel investigating and apologizing. We do not deal with the root cause, we just scrape the burned toast.

And then one day the chain reaction goes a bit further and we get a ‘Near Miss‘. That has a different reporting mechanism so it stimulates a bigger investigation and it usually culminates in some recommendations that involve more expensive checking, documenting and auditing of the checking and documentation. The root cause, the Niggles, go untreated – because there are too many of them.

But this check-and-correct reaction is also expensive and we need even more cash-fuel to keep the organizational engine running – but we do not have any more. Our budgets are capped. So we start cutting corners. A bit here and a bit there. And that increases the risk of more Niggles, Not Agains, and Near Misses.

Then the ‘Never Event‘ happens … a Safety and Quality catastrophe that triggers the financial conflagration and toasts the whole organization.

So although our financial firewalls, the Budgets, are partially effective they also have downsides:

1. Paradoxically they can create the perfect condition for a financial conflagration when too small a budget leads to corner-cutting on safety.

2. They lead to ‘off-loading’ which means that too-expensive-to-solve problems are chucked over the financial firewalls into the next department. The cost is felt downstream of the source – in a different department – and is often much larger. The sparks are blown downwind.

For example: a waiting list management department is under financial pressure and is running short staffed as a recruitment freeze has been imposed. The overburdening of the remaining staff leads to errors in booking patients for operations. The knock on effect that is patients being cancelled on the day and the allocated operating theatre time is wasted. The additional cost of wasted theatre time is orders of magnitude greater than the cost-saving achieved in the upstream stage. The result is a lower quality service, a greater cost to the whole system, and the risk that safety corners will be cut leading to a Near Miss or a Never Event.

The nature of real systems is that small perturbations can be rapidly amplified by a ‘tight’ financial design to create a very large and expensive perturbation called a ‘catastrophe’. A silo-based financial budget design with a cost-improvement thumbscrew feature increases the likelihood of this universally unwanted outcome.

So if we cannot use one big fuel tank or multiple, smaller, independent fuel tanks then what is the solution?

We want to ensure smooth responsiveness of our healthcare engine, we want healthcare cash-fuel-efficiency and we want low levels of toxic emissions (i.e. complaints) at the same time. How can we do that?

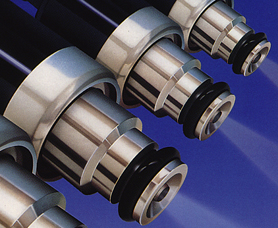

Fuel-injection.

Electronic Fuel Injection (EFI) designs have now replaced the old-fashioned, inefficient, high-emission carburettor-based engines of the 1970’s and 1980’s.

Electronic Fuel Injection (EFI) designs have now replaced the old-fashioned, inefficient, high-emission carburettor-based engines of the 1970’s and 1980’s.

The safer, more effective and more efficient cash-flow design is to inject the cash-fuel where and when it is needed and in just the right amount.

And to do that we need to have a robust, reliable and rapid feedback system that controls the cash-injectors.

But we do not have such a feedback system in healthcare so that is where we need to start our design work.

Designing an automated cash-injection system requires understanding how the Seven Flows of any system work together and the two critical flows are Data Flow and Cash Flow.

And that is possible.