Bing Bong

Bing Bong

Bob looked up from the report he was reading and saw the SMS was from Leslie, one of his Improvement Science Practitioners.

It said “Hi Bob, would you be able to offer me your perspective on another barrier to improvement that I have come up against.”

Bob thumbed a reply immediately “Hi Leslie. Happy to help. Free now if you would like to call. Bob“

Ring Ring

<Bob> Hello, Bob here.

<Leslie> Hi Bob. Thank you for responding so quickly. Can I describe the problem?

<Bob> Hi Leslie – Yes, please do.

<Leslie> OK. The essence of it is that I have discovered that our current method of cash-flow control is preventing improvements in safety, quality, delivery and paradoxically in productivity too. I have tried to talk to the Finance department and all I get back is “We have always done it this way. That is what we are taught. It works. The rules are not negotiable and the problem is not Finance“. I am at a loss what to do.

<Bob> OK. Do not worry. This is a common issue that every ISP discovers at some point. What led you to your conclusion that the current methods are creating a barrier to change?

<Leslie> Well, the penny dropped when I started using the modelling tools you have shown me. In particular when predicting the impact of process improvement-by-design changes on the financial performance of the system.

<Bob> OK. Can you be more specific?

<Leslie> Yes. The project was to design a new ambulatory diagnostic facility that will allow much more of the complex diagnostic work to be done on an outpatient basis. I followed the 6M Design approach and looked first at the physical space design. We needed that to brief the architect.

<Bob> OK. What did that show?

<Leslie> It showed that the physical layout had a very significant impact on the flow in the process and that by getting all the pieces arranged in the right order we could create a physical design that felt spacious without actually requiring a lot of space. We called it the “Tardis Effect“. The most marked impact was on the size of the waiting areas – they were really small compared with what we have now which are much bigger and yet still feel cramped and chaotic.

<Bob> OK. So how does that physical space design link to the finance question?

<Leslie> Well, the obvious links were that the new design would have a smaller physical foot-print and at the same time give a higher throughput. It will cost less to build and will generate more activity than if we just copied the old design into a shiny new building.

<Bob> OK. I am sure that the Capital Allocation Committee and the Revenue Generation Committee will have been pleased with that outcome. What was the barrier?

<Leslie> Yes, you are correct. They were delighted because it left more in the Capital Pot for other equally worthy projects. The problem was not capital it was revenue.

<Bob> You said that activity was predicted to increase. What was the problem?

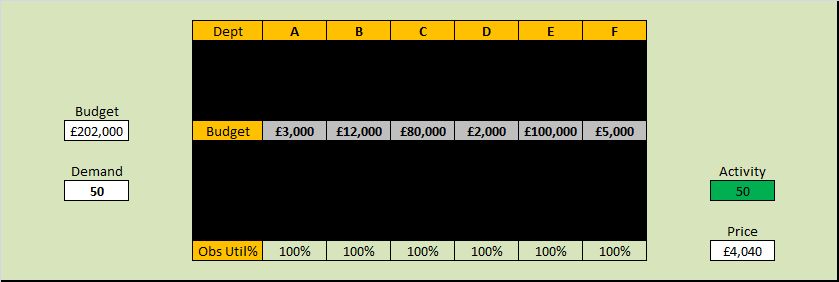

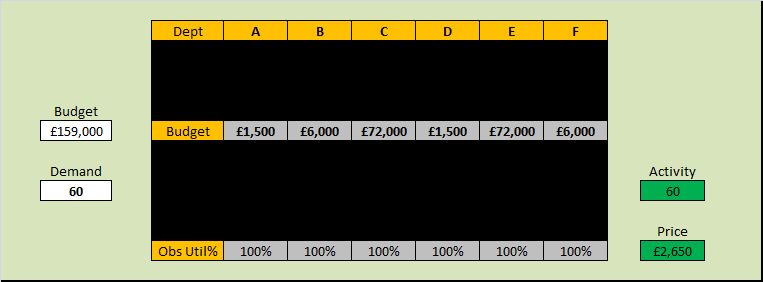

<Leslie>Yes – sorry, I was not clear – it was not the increased activity that was the problem – it was how to price the activity and how to distribute the revenue generated. The Reference Cost Committee and Budget Allocation Committee were the problem.

<Bob> OK. What was the problem?

<Leslie> Well the estimates for the new operational budgets were basically the current budgets multiplied by the ratio of the future planned and historical actual activity. The rationale was that the major costs are people and consumables so the running costs should scale linearly with activity. They said the price should stay as it is now because the quality of the output is the same.

<Bob> OK. That does sound like a reasonable perspective. The variable costs will track with the activity if nothing else changes. Was it apportioning the overhead costs as part of the Reference Costing that was the problem?

<Leslie> No actually. We have not had that conversation yet. The problem was more fundamental. The problem is that the current budgets are wrong.

<Bob> Ah! That statement might come across as a bit of a challenge to the Finance Department. What was their reaction?

<Leslie> To para-phrase it was “We are just breaking even in the current financial year so the current budget must be correct. Please do not dabble in things that you clearly do not understand.”

<Bob> OK. You can see their point. How did you reply?

<Leslie> I tried to explain the concepts of the Cost-Of-The-Queue and how that cost was incurred by one part of the system with one budget but that the queue was created by a different part of the system with a different budget. I tried to explain that just because the budgets were 100% utilised does not mean that the budgets were optimal.

<Bob> How was that explanation received?

<Leslie> They did not seem to understand what I was getting at and kept saying “Inventory is an asset on the balance sheet. If profit is zero we must have planned our budgets perfectly. We cannot shift money between budgets within year if the budgets are already perfect. Any variation will average out. We have to stick to the financial plan and projections for the year. It works. The problem is not Finance – the problem is you.“

<Bob> OK. Have you described the Seventh Flow and put it in context?

<Leslie> Arrrgh! No! Of course! That is how I should have approached it. Budgets are Cash-Inventories and what we need is Cash-Flow to where and when it is needed and in just the right amount according to the Principle of Parsimonious Pull. Thank you. I knew you would ask the crunch question. That has given me a fresh perspective on it. I will have another go.

<Bob> Let know how you get on. I am curious to hear the next instalment of the story.

<Leslie> Will do. Bye for now.

Drrrrrrrr

Creating a productive and stable system design requires considering Seven Flows at the same time. The Seventh Flow is cash flow.

Creating a productive and stable system design requires considering Seven Flows at the same time. The Seventh Flow is cash flow.

Cash is like energy – it is only doing useful work when it is flowing.

Energy is often described as two forms – potential energy and and kinetic energy. The ‘doing’ happens when one form is being converted from potential to kinetic. Cash in the budget is like potential energy – sitting there ready to do some business. Cash flow is like kinetic energy – it is the business.

The most versatile form of energy that we use is electrical energy. It is versatile because it can easily be converted into other forms – e.g. heat, light and movement. Since the late 1800’s our whole society has become highly dependent on electrical energy. But electrical energy is tricky to store and even now our battery technology is pretty feeble. So, if we want to store energy we use a different form – chemical energy. Gas, oil and coal – the fossil fuels – are all ancient stores of chemical energy that were originally derived from sunlight captured by vast carboniferous forests over millions of years. These carbon-rich fossil fuels are convenient to store near where they are needed, and when they are needed. But fossil fuels have a number of drawbacks: One is that they release their stored carbon when they are “burned”. Another is that they are not renewable. So, in the future we will need to develop better ways to capture, transport, use and store the energy from the Sun that will flow in glorious abundance for millions of years to come.

Plants discovered millions of years ago how to do this sunlight-to-chemical energy conversion and that biological legacy is built into every cell in every plant on the planet. Animals just do the reverse trick – they convert chemical-to-electrical. Every cell in every animal on the planet is a microscopic electrical generator that “burns” chemical fuel – carbohydrate. The other products are carbon dioxide and water. Plants use sunlight to recycle and store the carbon dioxide. It is a resilient and sustainable design.

Plants seemingly have it easy – the sunlight comes to them – they just sunbathe all day! The animals have to work a bit harder – they have to move about gathering their chemical fuel. Some animals just feed on plants, others feed on other animals, and we do a bit of both. This food-gathering is a more complicated affair – and it creates a problem. Animals need a constant supply of energy – so they have to carry a store of chemical fuel around with them. That store is heavy so it needs energy to move it about. Herbivors can be bigger and less intelligent because their food does not run away. Carnivors need to be more agile; both physically and mentally. A balance is required. A big enough fuel store but not too big. So, some animals have evolved additional strategies. Animals have become very good at not wasting energy – because the more that is wasted the more food that is needed and the greater the risk of getting eaten or getting too weak to catch the next meal.

Plants seemingly have it easy – the sunlight comes to them – they just sunbathe all day! The animals have to work a bit harder – they have to move about gathering their chemical fuel. Some animals just feed on plants, others feed on other animals, and we do a bit of both. This food-gathering is a more complicated affair – and it creates a problem. Animals need a constant supply of energy – so they have to carry a store of chemical fuel around with them. That store is heavy so it needs energy to move it about. Herbivors can be bigger and less intelligent because their food does not run away. Carnivors need to be more agile; both physically and mentally. A balance is required. A big enough fuel store but not too big. So, some animals have evolved additional strategies. Animals have become very good at not wasting energy – because the more that is wasted the more food that is needed and the greater the risk of getting eaten or getting too weak to catch the next meal.

To illustrate how amazing animals are at energy conservation we just need to look at an animal structure like the heart. The heart is there to pump blood around. Blood carries chemical nutrients and waste from one “department” of the body to another – just like ships, rail, roads and planes carry stuff around the world.

Blood is a sticky, viscous fluid that requires considerable energy to pump around the body and, because it is pumped continuously by the heart, even a small improvement in the energy efficiency of the circulation design has a big long-term cumulative effect. The flow of blood to any part of the body must match the requirements of that part. If the blood flow to your brain slows down for even few seconds the brain cannot work properly and you lose consciousness – it is called “fainting”.

Blood is a sticky, viscous fluid that requires considerable energy to pump around the body and, because it is pumped continuously by the heart, even a small improvement in the energy efficiency of the circulation design has a big long-term cumulative effect. The flow of blood to any part of the body must match the requirements of that part. If the blood flow to your brain slows down for even few seconds the brain cannot work properly and you lose consciousness – it is called “fainting”.

If the flow of blood to the brain is stopped for just a few minutes then the brain cells actually die. That is called a “stroke”. Our brains use a lot of electrical energy to do their job and our brain cells do not have big stores of fuel – so they need constant re-supply. And our brains are electrically active all the time – even when we are sleeping.

Other parts of the body are similar. Muscles for instance. The difference is that the supply of blood that muscles need is very variable – it is low when resting and goes up with exercise. It has been estimated that the change in blood flow for a muscle can be 30 fold! That variation creates a design problem for the body because we need to maintain the blood flow to brain at all times but we only want blood to be flowing to the muscles in just the amount that they need, where they need it and when they need it. And we want to minimise the energy required to pump the blood at all times. How then is the total and differential allocation of blood flow decided and controlled? It is certainly not a conscious process.

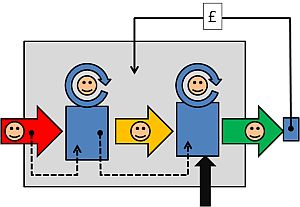

The answer is that the brain and the muscles control their own flow. It is called autoregulation. They open the tap when needed and just as importantly they close the tap when not needed. It is called the Principle of Parsimonious Pull. The brain directs which muscles are active but it does not direct the blood supply that they need. They are left to do that themselves.

The answer is that the brain and the muscles control their own flow. It is called autoregulation. They open the tap when needed and just as importantly they close the tap when not needed. It is called the Principle of Parsimonious Pull. The brain directs which muscles are active but it does not direct the blood supply that they need. They are left to do that themselves.

So, if we equate blood-flow and energy-flow to cash-flow then we arrive at a surprising conclusion. The optimal design, the most energy and cash efficient, is where the separate parts of the system continuously determine the energy/cash flow required for them to operate effectively. They control the supply. They autoregulate their cash-flow. They pull only what they need when they need it.

BUT

For this to work then every part of the system needs to have a collaborative and parsimonious pull-design philosophy – one that wastes as little energy and cash as possible. Minimum waste of energy requires careful design – it is called ergonomic design. Minimum waste of cash requires careful design – it is called economic design.

Many socioeconomic systems are fragmented and have parts that behave in a “greedy” manner and that compete with each other for resources. It is a dog-eat-dog design. They would use whatever resources they can get for fear of being starved. Greed is Good. Collaboration is Weak. In such a competitive situation a rigid-budget design is a requirement because it helps prevent one part selfishly and blindly destabilising the whole system for all. The problem is that this rigid financial design blocks change so it blocks improvement.

Many socioeconomic systems are fragmented and have parts that behave in a “greedy” manner and that compete with each other for resources. It is a dog-eat-dog design. They would use whatever resources they can get for fear of being starved. Greed is Good. Collaboration is Weak. In such a competitive situation a rigid-budget design is a requirement because it helps prevent one part selfishly and blindly destabilising the whole system for all. The problem is that this rigid financial design blocks change so it blocks improvement.

This means that greedy, competitive, selfish systems are unable to self-improve.

So, when the world changes too much and their survival depends on change then they risk becoming extinct just as the dinosaurs did.

Many will challenge this assertion by saying “But competition drives up performance“. Actually, it is not as simple as that. Competition will weed out the weakest who “die” and remove themselves from the equation – apparently increasing the average. What actually drives improvement is customer choice. Organisations that are able to self-improve will create higher-quality and lower-cost products and in a globally-connected-economy the customers will vote with their wallets. The greedy and selfish competition lags behind.

Many will challenge this assertion by saying “But competition drives up performance“. Actually, it is not as simple as that. Competition will weed out the weakest who “die” and remove themselves from the equation – apparently increasing the average. What actually drives improvement is customer choice. Organisations that are able to self-improve will create higher-quality and lower-cost products and in a globally-connected-economy the customers will vote with their wallets. The greedy and selfish competition lags behind.

So, to ensure survival in a global economy the Seventh Flow cannot be rigidly restricted by annually allocated departmental budgets. It is a dinosaur design.

And there is no difference between public and private organisations. The laws of cash-flow physics are universal.

How then is the cash flow controlled?

The “trick” is to design a monitoring and feedback component into the system design. This is called the Sixth Flow – and it must be designed so that just the right amount of cash is pulled to the just the right places and at just the right time and for just as long as needed to maximise the revenue. The rest of the design – First Flow to Fifth Flow ensure the total amount of cash needed is a minimum. All Seven Flows are needed.

So the essential ingredient for financial stability and survival is Sixth and Seventh Flow Design capability. That skill has another name – it is called Value Stream Accounting which is a component of complex adaptive systems engineering (CASE).

What? Never heard of Value Stream Accounting?

Maybe that is just another Error of Omission?

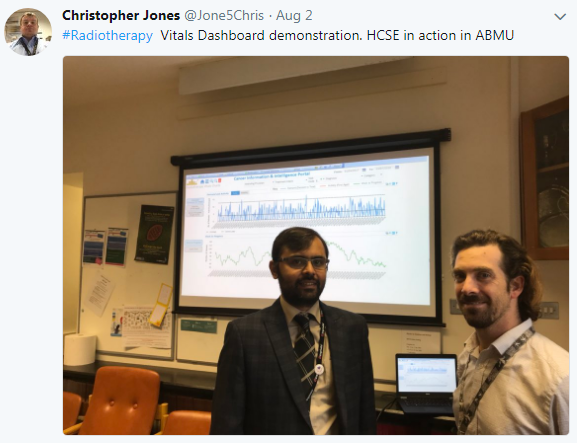

In medicine we have the concept of ‘vital signs’ … a small number of objective metrics that we can measure easily and quickly. With these we can quickly assess the physical health of a patient and decide if we need to act, and when.

In medicine we have the concept of ‘vital signs’ … a small number of objective metrics that we can measure easily and quickly. With these we can quickly assess the physical health of a patient and decide if we need to act, and when.